Overcoming the Overhead Myth

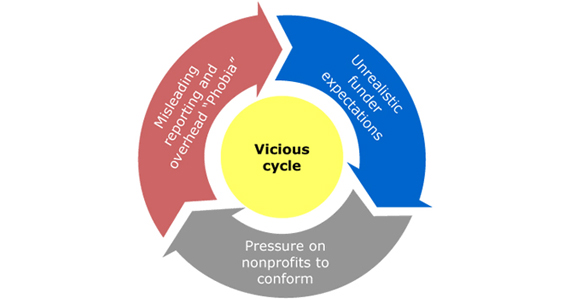

If you work in the non-profit sector then you’ve almost certainly come across Dan Pallotta’s highly influential TED talk from 2009 ‘The Way We Think About Charity Is Dead Wrong’ – and if you haven’t then we would strongly urge you to do so. The key element of the TED talk is the concept of ‘The Overhead Myth’ – the ingrained and persistent belief that a non-profit organization’s key aim should always be to limit and reduce its overhead above all other objectives. There’s a belief that spending money on fundraising efforts, advertising campaigns and talented, experienced personnel is somehow contrary to the aims of a charity – and that causes a problem for the non-profit sector. If you’re ever going to grow your charity, increase your fundraising income and…