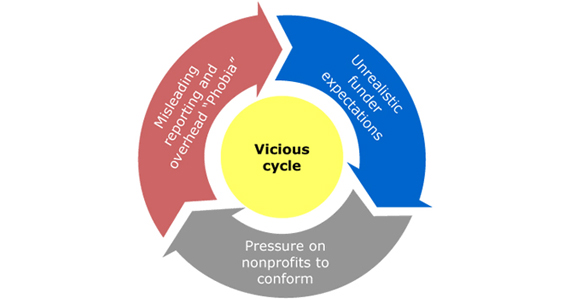

Focusing on Overhead: The Nonprofit Circle

Business Advisory, FREE Business Tools: Learn the Secrets, Non Profit Principles: Steering You in the Right Direction

Think about how you donate to charities; do you focus on the percentage of your dollar that will actually go towards the cause? If for every one dollar donated 50% of the amount goes towards the cause, would you still donate? How about 40%? 30%? 10%? Here is some food for thought. Overhead expenses and the cause or goal of the nonprofit can be two good measurable indicators of success within a nonprofit organization. The Bill and Melinda Gates Foundation point out that they use many measurable indicators to prove their cause is a success without limiting themselves to JUST the overhead metric. Their causes or goals are measurable, attainable, and set within a time limit to encourage continued movement towards the goal/cause. SMART goals, as you might have heard them referred to in…